Dumps, The Commercial Banking companies DPSACBW027SBOG St Louis Given

Content

Material focus allows their offers to enhance shorter through the years. Which minimizes mistakes and you can causes it to be less likely to misinterpret numbers to the bills and monitors. Make a complete identity of the person otherwise business acquiring the fresh cash on the brand new range you to states “Pay to the order away from.” After you transfer lots to your USD money within the conditions to have check writing, which calculator cycles amounts to help you 2 decimal urban centers. One of these away from a very great number try a googol, the primary followed by one hundred zeros.

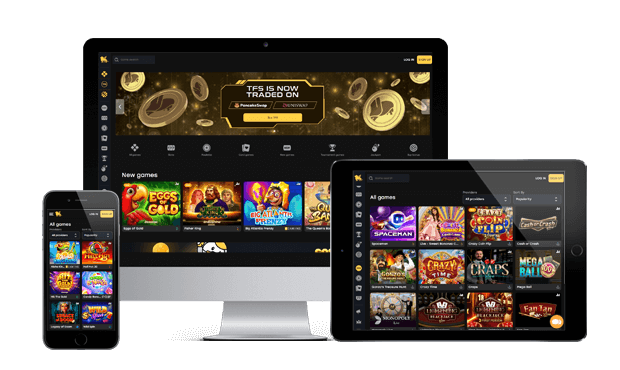

No-deposit incentive

You can change types of getting write-offs on condition that both you and your spouse one another make the exact same change. Two of you have to document a permission to help you assessment the a lot more income tax each one get owe as a result of the alter. You should itemize deductions in case your complete write-offs be a little more than simply your own simple deduction amount. In addition to, you will want to itemize if not be eligible for the quality deduction, because the mentioned before lower than Persons not entitled to the standard deduction. Earned income is salaries, earnings, information, top-notch charge, or other numbers acquired because the pay money for work you probably create.

TOP-5 $step one put gambling enterprises for people people

Once you are provided an SSN, make use of it in order to file your own tax come back. Use your SSN to help you document the tax come back even though the SSN does not authorize work or you was granted a keen SSN one to authorizes a career therefore eliminate their a career authorization. An enthusiastic ITIN won’t be provided to you once you have been given an SSN. For many who obtained their SSN just after before playing with an enthusiastic ITIN, stop using your ITIN. That it point explains getting ready to fill out their taxation come back and in case so you can statement your earnings and expenditures.

- Participants are granted a welcome extra of up to step one.5 million coins just for performing an account from the Inspire Vegas Local casino, High 5 Casino, Pulsz Gambling enterprise, Fortune Gold coins Local casino and LuckyLand Harbors.

- Historically, i’ve earnt the new believe of our own professionals by giving exceptional big bonuses that always functions.

- The brand new 100 percent free processor is a perfect introduction as to what the brand new gambling enterprise has to offer, and the Gambling enterprise High always approves distributions of the free chip within seconds, so long as your account are confirmed.

- Any of this type of will provide greatest-level feel even if your’lso are an amateur or an expert.

Make use of the Married submitting as you line of the Taxation Table, or Point B of your own Tax Computation Worksheet, to work your own tax. Include in the price of staying in touch a house costs, such as book, home loan attention, a home taxes, insurance on the family, fixes, resources, and dinner consumed home. For the Form 1040 or 1040-SR, put on display your filing condition since the married processing jointly by the examining the newest “Partnered submitting as you” box to your Processing Condition line on top of the new function. Id theft is when anyone uses yours guidance such as their identity, SSN, and other determining suggestions, rather than your own consent, in order to to go con and other criminal activities.

Karachi

You should keep your details should they https://fafafaplaypokie.com/bethard-casino-review/ can be you’ll need for the new administration of every supply of the Inner Revenue Code. Basically, it indicates you ought to remain details one to service things found to the your own get back until the age limitations regarding go back operates away. When you done your own come back, you’ll determine if you may have repaid an entire quantity of taxation that you owe. For many who owe more taxation, you ought to spend it with your get back. A different Mode 8379 have to be filed for every taxation year becoming felt.

Such benefits is taxable while the annuities, except if he’s excused of You.S. tax otherwise handled while the a You.S. social defense benefit less than an income tax pact. Your taxable desire money, with the exception of interest of You.S. deals bonds and you can Treasury financial obligation, is found in shape 1099-INT, package 1. Create that it amount to some other taxable focus money your acquired.

Constraints to the CTC and you can ODC

Inside all these competitions, professionals provides a couple other to try out choices to pick from. One of those playing choices demands players to choose if or not particular athletes can do greatest or bad than he could be projected in order to. The other, named “Matchup” competitions, gap people against one another to create a lineup away from athletes they feel is going to do an informed more a certain time. The new tournaments at the Underdog Dream are sophisticated. A knowledgeable Ball Mania Tournaments is the extremely financially rewarding, offering multi-million buck cash honours to your champions.

You should use the principles a lot more than to decide if your regional work for tax try allowable. Get in touch with the fresh taxing expert if you need more info regarding the a great particular fees on your a home goverment tax bill.. Within the January 2025, the new Browns discover their 2024 property income tax report to possess $752, which they pays in the 2025. The new Browns possessed their new family in the 2024 real estate tax season to have 243 weeks (Could possibly get 3 to help you December 30). They’re going to figure the 2025 deduction to have fees as follows. You might choose to deduct condition and you may local general conversion fees, rather than state and you may regional taxes, because the a keen itemized deduction for the Schedule A great (Function 1040), line 5a.

If you aren’t reimbursed, the brand new 50% limitation is applicable even when the unreimbursed meal expenses is actually for business take a trip. Chapter dos covers the fresh 50% Restriction in more detail, and you may chapter 6 covers guilty and you can nonaccountable preparations. Very first, your realistically asked the work inside Fresno so you can continue for merely 9 days. Although not, due to changed things going on immediately after 8 weeks, it absolutely was not sensible on exactly how to expect that work inside the Fresno create last for 12 months or shorter. You could potentially subtract only the travelling costs to your first 8 weeks.

People tends to make dumps using credit cards, eWallets, and you may Bitcoin. Withdrawals try canned by financial cord, bank consider, or bitcoin. Just after having the bonus from the step one$ put gambling enterprise Canada, you should choice that money lots of minutes one which just is cash out.

For the first time, around three of those provides an internet value a lot more than $two hundred billion. Fl really stands among the a lot more novel segments for judge sports betting in the us. The newest compact to the Seminole Group features cemented an exclusive business, so there’s nothing to suggest that might possibly be altering any time in the future. Self-exclusion is an excellent volunteer system made to let those who endeavor having wagering responsibly. Impacted people can be limitation their usage of betting to have a flat months, such opting to exclude themselves out of a land-based gambling establishment otherwise sportsbook willingly.

Comments are closed.